Rinehart on the Money

Gina Rinehart said some inconvenient truths in comparing our politician's policy performance with that of the CCP.

DeFi will change the current financial system and will impact almost every conceivable contractual relationship. It's just getting started.

We often experience incredible societal change that replace one method of doing something with another.

These substantive shifts are usually ignored by the mainstream until the change becomes so normalised that almost everyone is using it.

Email replacing the letter is a prime example. So to was the adoption of the Internet and the use of the smart phone.

Decentralised Finance (DeFi) is another one, albeit in the very early stages.

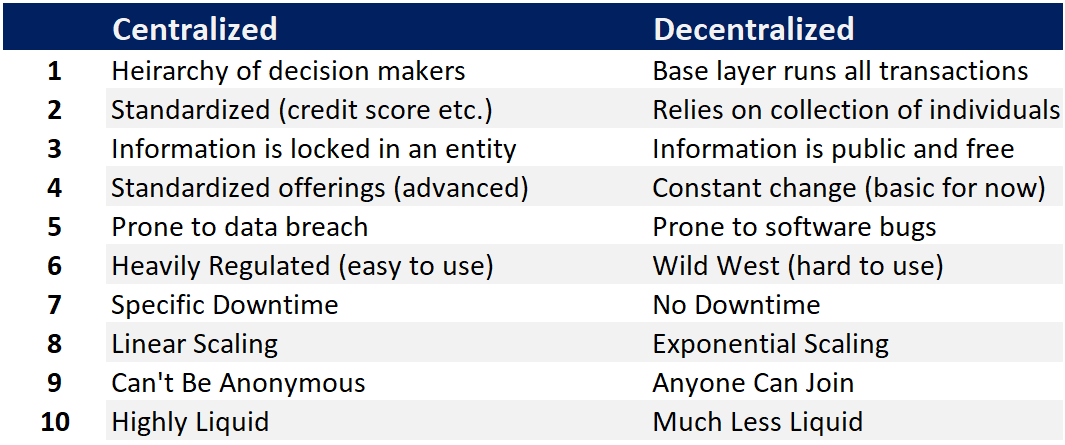

DeFi is the use of smart contracts on the blockchain to allow secure transactions without intermediaries or middlemen.

It also allows the investment of crypto coins and tokens to receive fees and interest on your crypto assets. They allow for loans to be taken out against crypto assets without a bank.

This is important for several reasons.

The first is that it allows asset holders to obtain funds without selling their assets and thereby avoiding a taxable event.

Secondly, by lending your assets you not only participate in the price appreciation of the asset but you an also receive a yield on your holdings.

Another value of these smart contracts is that it allows businesses to raise funds without having to pay exorbitant fees to bankers. They can even build limits, restrictions or benefits into the contracts to reward long term holders or dissuade speculators.

Eventually, these contracts will come to represent the ownership of almost every substantive asset from shares to bonds to property.

The implications of this in reducing the cost of doing business is extraordinary.

Example: If a company stock is represented through tokens on the blockchain, there are no constraints to being able to transact that stock every hour of every day. That essentially does away with the need for stock exchanges, stock brokers and share registries. Instead, all transactions will be done through a decentralised exchange.

In the current world of finance, convenience and security has led to the creation of centralised bodies to provide services - stockbrokers, banks etc. This happens in the crypto space too where your assets are held by third parties on your behalf.

Historically, these centralised firms have suffered hacks or fraud where billions of dollars worth of crypto has been stolen. That's why the experienced holder knows the importance of having holdings outside of these firms.

DEXs provide an alternative whereby they facilitate transactions directly between individuals without intermediaries.

They do this by having pools of coins available to ensure immediate execution of the exchange. The coins in these pools are pledged by investors who receive a portion of the transaction cost as a reward for providing the liquidity.

There are many different DEXs available and they are all competing for market share on cost, ease of use and accessibility - much like traditional financial firms compete today.

Join 50K+ readers of the no spin Weekly Dose of Common Sense email. It's FREE and published every Wednesday since 2009