Weekend Open Forum

There's plenty to ponder in this crazy world of ours. Here's the place to do it.

I've been trying to make sense of the financial markets for months now. When the global economy has been crushed, the stock markets have had a stellar run - particularly in the United States.

Some of that boom could be explained by the weight of money fleeing negative yielding bonds and deflating currencies into the deep well of USD denominated stocks. It's also clear that the 'boom' has really been concentrated in only a relative handful of companies.

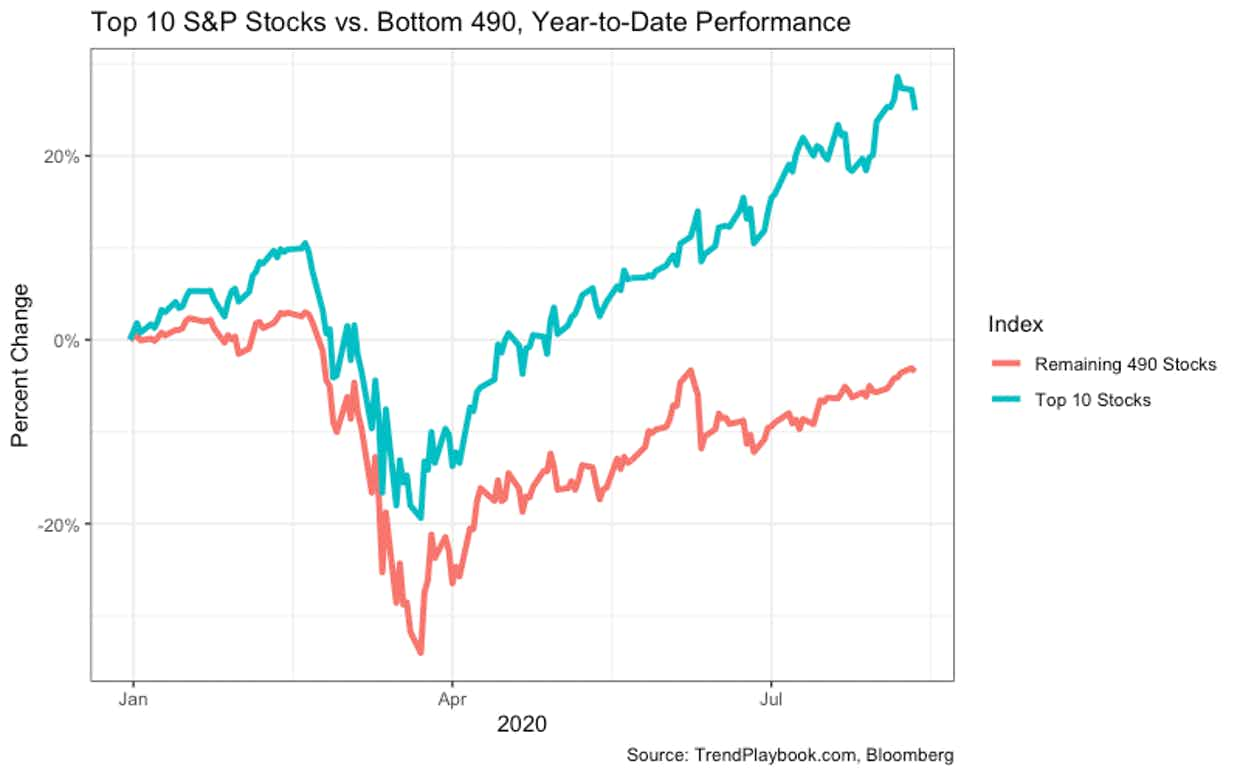

The ten largest stocks comprising the S&P 500 index (includes Facebook, Apple, Google, Amazon and Microsoft) comprise about 30 per cent of the total value of that index. They are also responsible for the record highs being generated.

In fact, the top ten rose by more than 25 per cent this year and if you exclude their performance, the S&P 500 would be down around 5 per cent for the year. I think that's a better indication of how the economy is travelling.

However, the startling performance in tech isn't based on fundamental business performance but on a feedback loop that drives prices higher. In short, they have been manipulated higher by an investor with very deep pockets.

That investor is a Japanese company named Softbank.

Softbank built a reputation as a venture capital funder and was a large investor in a number of startup companies. Some worked very well but others ultimately ended poorly. Not long ago, they stated they were going to become investors in listed companies too.

It now appears they spent around $4 billion buying call options on some of the big tech companies listed above. This gave them exposure to around $30 billion in stock - a highly leveraged bet.

The sellers of these options then had to hedge their risk by purchasing the stocks in the market. This gave the stock prices a bit of a boost, causing the call options to rise in price.

The call option price increase made the option sellers purchase even more stock to protect themselves.

This upward momentum was seized upon by the army of unemployed day traders punting their own highly leveraged Robin Hood ( a trading brokerage) accounts, who jumped on board, driving prices even higher.

And so the self re-enforcing feedback loop continued as almost everyone seemed to be on board the wildest tech party since 1999.

Last week, the music stopped and some of those big tech names began to fall from their stratospheric valuations. This appears to be the correction we forecast and wrote about in late August.

Just what is to come in the weeks ahead is still uncertain. It appears that Softbank still has billions invested in their call options which have seen them double their money. However, they have to eventually unwind those positions or exercise their options in order to lock in their gains.

Their profit will come from someone else's pocket and that makes for an interesting showdown between the big end of town.

Now that the Softbank trade strategy is known, equally big players will be implementing their own strategies to profit at Softbank's expense. This will likely be done by driving big tech stock prices down.

If that happens, it will be the first time since day trading for the unemployed became popular that the tech darlings undergo a corrective fall. This will test the nerve and trading strategy of the market newbies.

It could also decimate the trading accounts of those who can least afford it.

Join 50K+ readers of the no spin Weekly Dose of Common Sense email. It's FREE and published every Wednesday since 2009