They Just Picked a Side

John Roskam from the Institute of Public Affairs highlights the failures of the fourth estate to hold our politicians (and other institutions) to account.

The money printing has masked the real return in many investment markets. Here's some clarity.

If you are an investor you probably think you’ve done alright in recent years.

Interest rates have been low, borrowing has been easy and aside from the COVID hiccup, things have been pretty predictable for more than a decade.

You may look at the value of your investments and think everything is pretty good.

And you’d be right – compared with the person who doesn’t have a home, or investment properties, stocks and shares.

They’ve been left well behind as the divide between the haves and have nots has expanded.

But here’s something I bet you don’t know.

When compared with the expansion of the USD money supply, the major stock indices of the world have put in a negative performance over the past 14 years.

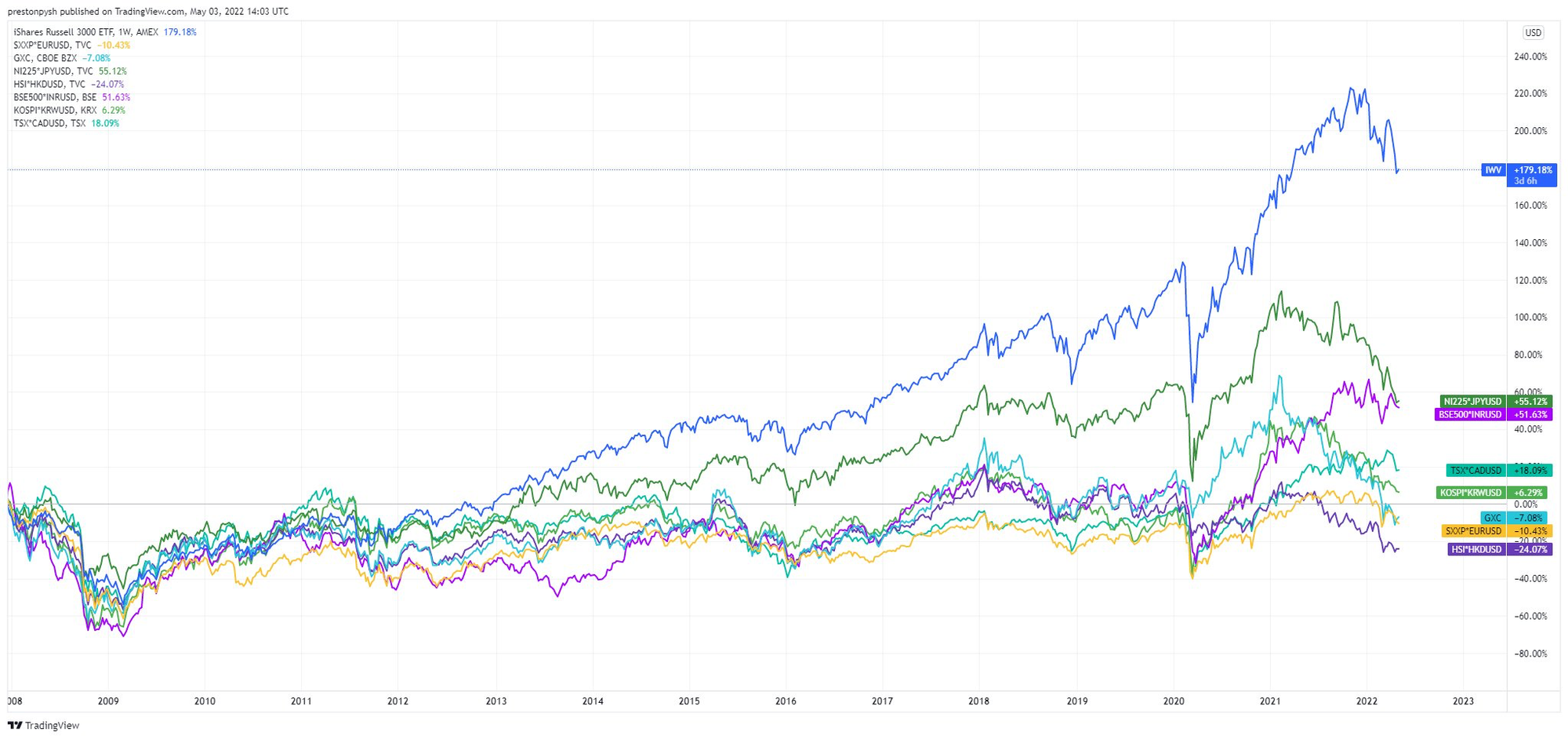

Here’s the graph from TradingView.com

This shows that stocks have actually fallen in relation to the money supply inflation as measured by M2 – that’s the cash and cash equivalents.

For example, while the US stock market is up 179% over the fourteen years, the money supply has increased by more than that. Meaning US stocks have actually fallen in real terms by 3%

It’s the same in Japan, down 47%, Canada – down 64%m China – 68% and Europe -70%.

Investors in those broad markets have been smoked in USD terms over the past fourteen years.

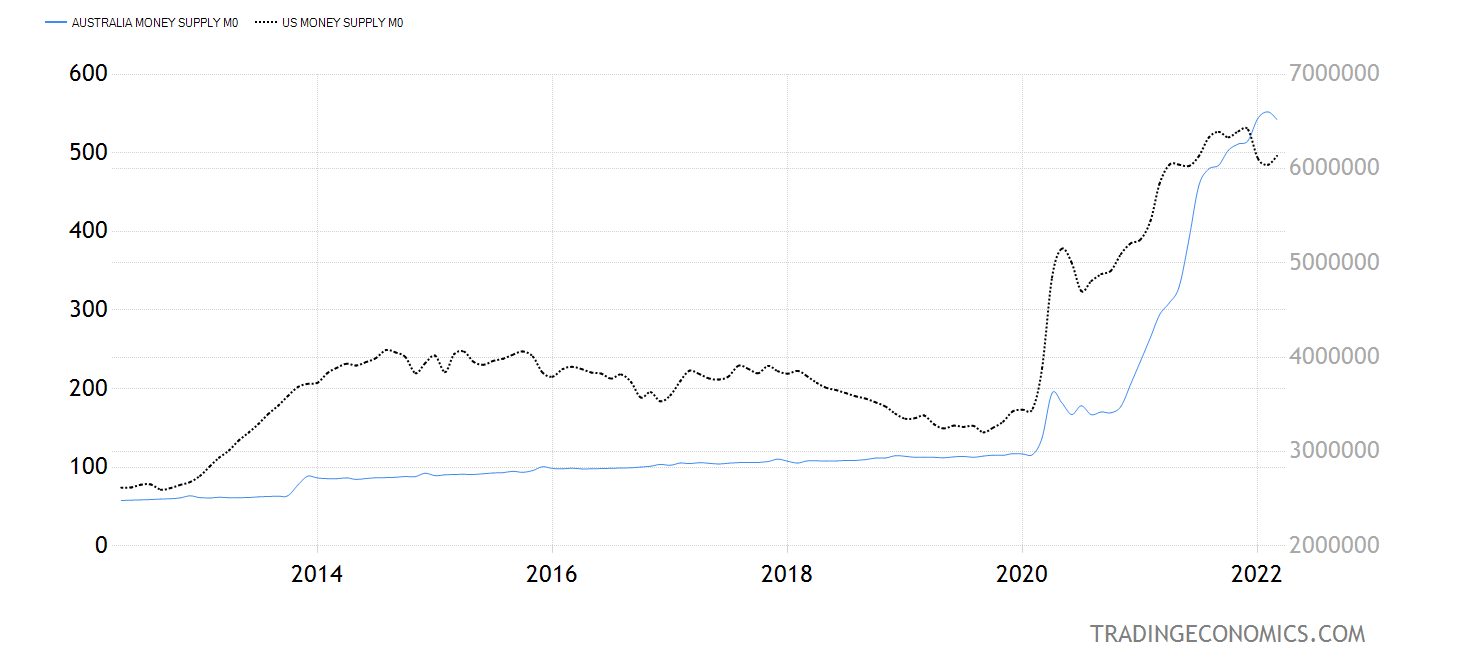

Here’s a chart of the comparative money supply expansion (notes and coins in circulation) between the US and Australia over the past decade.

We more than hold our own in this race to debase the currency.

That’s why Aussie investors are likely feeling poorer even though their ‘worth’ is up. Money printing has outperformed investment performance.

That’s helping to deliver the inflation and interest rate rises we have seen in recent weeks.

All this contributes to why some big fund managers are calling for even darker investment days ahead.

There’s already pain almost everywhere you look.

The tech laden NASDAQ index is down 20% from its November peak – that’s officially a bear market – while the S&P 500 is off around 12%

In Australia, our ASX 200 index is down around 7% this year.

Those falls haven’t stopped experienced investment professionals from calling for even tougher days ahead.

The co-founder of Sierra Investment Management, David Wright, told Bloomberg this week that:

"I believe we are in the biggest bear market in my life…This is just the second inning. A lot more to come."

So is he right; are they warning bells or the chimes of opportunity we hear?

Join 50K+ readers of the no spin Weekly Dose of Common Sense email. It's FREE and published every Wednesday since 2009